You open your mailbox and find an unexpected check along with a letter promising you thousands of dollars in settlement money. It sounds too good to be true, and in many cases, it is. Fake settlement checks and fraudulent insurance offers are becoming increasingly common across Washington State, and Seattle residents are not immune.

Scammers are getting smarter. Their letters look official, their checks appear legitimate, and their stories are convincing enough to fool even careful people. Before you sign anything, deposit that check, or call the number on that letter, it helps to understand the benefits hiring personal injury lawyer to ensure you are not being targeted.

Whether you received an unexpected check from an insurance company you have never heard of, a notice about a class action settlement you do not remember joining, or a letter pressuring you to act fast, this guide will help you figure out if your settlement offer is real and what steps to take to protect yourself.

Benefits of Hiring A Personal Injury Lawyer to Protect Yourself

In the last year there have been numerous articles and news stories across the country about fake settlement offers from insurance companies, in particular Nationwide Insurance. It’s quite clear that they’re fake because people are getting calls and letters about car accidents that they haven’t been in, or insurance companies that they don’t have a policy with. These scams serve as a stark reminder that insurance not always on side after a crash. Here’s some information you should be aware of, and things to look out for.

Utah resident Jerrian Adams recently shared her own experience dealing with this type of fraudulent cases on KUTV. After getting a check for $1,300 from Nationwide, despite not being a customer, along with a letter explaining how she was also entitled to a $75,000 settlement. When she called the number listed, she was given less-than-convincing instructions that she needed to wire them money to get the funds she supposedly due. Thankfully, Adams caught on quick.

This is far from the typical experience in this situation. The problem has gotten so widespread that the Better Business Bureau put out an official statement to alert consumers about the scam. The fake settlement offers will often come with a check and a letter telling you to call about details. If you get a suspicious letter like this, it is vital to know when to call Elsner Law Firm for guidance. However, don’t use the number on the letter – call from a number you find online or else you might find yourself being verbally threatened like Adams and others have in these cases. You can also contact the insurance commissioner to see if they’ve had similar complaints.

How to Tell If a Settlement Check Is Real

If you’ve received an unexpected check in the mail, it’s natural to wonder whether it’s legitimate. Here are key steps to verify before you do anything with it:

- Check the case name and court information. A real settlement check will reference an actual court case. You can search the case name on PACER (the federal court database) or your state’s court records portal to confirm it exists.

- Look up the settlement administrator independently. Do not use any phone number printed on the check or letter. Search the administrator’s name online and contact them through their official website.

- Verify the law firm involved. Real class action settlements are tied to real law firms. Search the firm’s name through your state bar association to confirm they are licensed and in good standing.

- Watch for upfront fees. Legitimate settlement payments never require you to wire money, pay a processing fee, or provide gift card numbers to receive your funds. This is the single biggest red flag.

- Cross-reference with trusted sources. Websites like TopClassActions.com or the official settlement website listed in court documents can help you confirm whether a settlement is real and whether you qualify.

If anything about the check feels “off,” stop. Do not sign, deposit, or cash it until you have verified it through independent sources.

Is the Settlement Company That Contacted You Legitimate?

Many readers reach out asking about specific companies they’ve heard from, such as Kroll Settlement Administration, Phoenix Settlement Administrators, Rust Consulting, Zimmerman Reed, CPT Group, and others. The good news is that several of these are real, court-appointed companies that handle legitimate class action payouts.

Kroll Settlement Administration is a widely used, legitimate settlement administrator. If you received a check or letter from them, search the case name referenced in the letter to confirm the settlement is real. Similarly, Phoenix Settlement Administrators, Rust Consulting, and Zimmerman Reed are established companies that have administered real settlements for major cases.

SettleMate is a newer app that allows users to find and file claims for class action settlements. While the concept is real, you should always verify any settlement opportunity independently before submitting personal information through a third-party app.

The key rule for any settlement administrator, known or unknown, is this: search the company name plus the words “class action settlement” online, check the Better Business Bureau, and confirm the court case is real. Legitimate administrators will never ask you to pay money upfront to receive your settlement funds.

Real Settlement Checks You May Have Received Recently

Not every unexpected check is a scam. In recent years, several major companies have been involved in legitimate class action settlements, and millions of Americans have received checks they weren’t expecting. Here are some real examples:

- T-Mobile Data Breach Settlement: T-Mobile agreed to a $350 million settlement following a 2021 data breach. Many affected customers received checks or payment notifications from a settlement administrator. This is real.

- FTC Amazon Prime Subscription Settlement: The FTC reached a settlement with Amazon over unauthorized Prime subscriptions. Eligible consumers received checks from the settlement fund.

- AT&T Settlement: AT&T has been involved in multiple class action settlements related to data throttling and billing practices. If you received an AT&T settlement notice, verify it through the official settlement website.

- Equifax Data Breach Settlement: Following the massive 2017 data breach, Equifax settled for up to $700 million. Many consumers received small payments or credit monitoring offers.

- TurboTax Settlement: Intuit (TurboTax) settled with states over steering customers to paid products when they qualified for free filing. Real checks were mailed to eligible users.

If you received a check related to any of these or another well-known company, look up the official settlement website before taking any action. The mere fact that you did not file a claim does not mean a check is fake, as some settlements automatically distribute funds to affected consumers.

What to Do If You Are Expecting a Real Insurance Settlement

If you’ve been in an accident and are expecting money from an insurance company, getting a check and letter like this can make a confusing situation even more bewildering, particularly if it is the first settlement offer from insurance companies. But before you do anything, make sure you closely look at the document before signing it and inspect it for anything that may strike you as “odd.” A discerning eye will save you a lot of trouble.

Usually the insurance company will send payment for the vehicle first without a settlement agreement. Later, after you have finished treating, you will get a settlement agreement to finalize your claim. Some sneaky insurance companies will even try to get you to waive all of your claims when they pay for the car, which highlights the risks of settling too soon before you are fully healed. If you’re afraid this is happening, you should have an attorney review the paperwork before you cash the check.

How Settlement Scams Work: The Most Common Types

Understanding how these scams operate can help you avoid them. There are three main types of settlement fraud to be aware of:

1. Fake Check Overpayment Scams This is the most common type. You receive a check, often for a small amount, along with a letter claiming you are entitled to a much larger sum. You’re instructed to deposit the check and wire back a portion to cover “taxes,” “processing fees,” or “administrative costs.” The original check eventually bounces, and you are left owing the money you wired.

2. Phishing Letters and Emails Some scammers send official-looking settlement notices designed to harvest your personal information, including your Social Security number, bank account details, or date of birth. They pose as legitimate settlement administrators and ask you to “verify your identity” to receive your funds.

3. Unsolicited Structured Settlement Buyers If you are already receiving structured settlement payments, you may be targeted by companies offering to buy your future payments for a lump sum. In some legal contexts, it’s also important to understand bad faith for personal injury tactics used by actual insurers.

Knowing these patterns makes it significantly easier to spot a scam before it costs you.

Were You Targeted by a Fake Settlement? Here Is What to Do

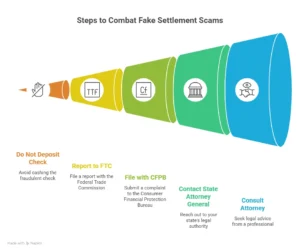

If you believe you have been targeted by a settlement scam, here are the steps to take immediately:

- Do not deposit or cash the check. Once you deposit a fraudulent check, you can be held liable for the funds when it bounces.

- Report it to the FTC. File a complaint at ReportFraud.ftc.gov. The FTC actively investigates settlement fraud.

- File a complaint with the CFPB. If the scam involved financial products or services, the Consumer Financial Protection Bureau (consumerfinance.gov) accepts complaints.

- Contact your state attorney general. Most state AG offices have a consumer protection division that handles fraud complaints.

- Reach out to an attorney. If you have already lost money or signed documents under false pretenses, you might ask if unwinding a settlement is possible to recover your rights.

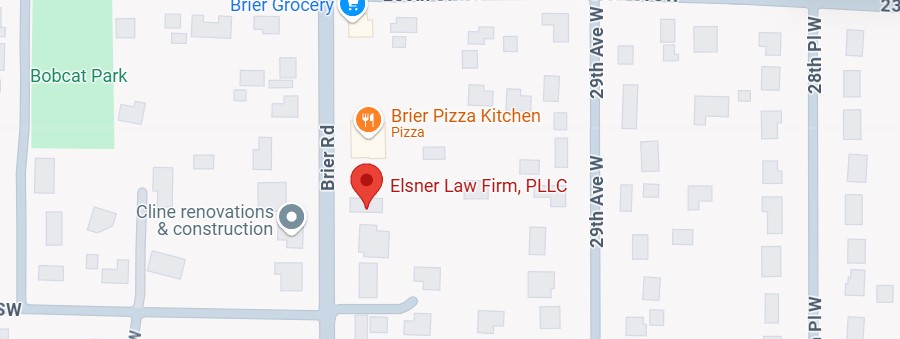

How Elsner Law Firm Can Help

Elsner Law Firm would be glad to review any paperwork you receive that seems suspect. And, if you find yourself in a legitimate case, we can explain how much a case really take to resolve in the current legal climate. We offer free consultations so we can hear your concerns and determine what next steps we could take. Reach out to us today.

Frequently Asked Questions

1. How do I know if a settlement check I received in the mail is real?

Start by identifying the case name and settlement administrator listed on the check or letter. Search the case independently through PACER or your state court records to confirm it exists. Then contact the settlement administrator using a phone number or website you find through your own search, not the one printed on the letter. If the check asks you to wire any money back or pay a fee, it is a scam.

2. Is Kroll Settlement Administration a legitimate company?

Yes. Kroll Settlement Administration (also referred to as Kroll) is a legitimate, court-appointed settlement administrator that has handled distributions for major class action cases including the T-Mobile data breach settlement. If you received a check or letter from Kroll, verify the specific case it references through the official court records or the dedicated settlement website listed in your notice.

3. I received a check from an insurance company I don’t have a policy with. What should I do?

Do not cash or deposit the check. This is a common sign of a fake settlement scam. Contact the insurance company directly using a phone number from their official website, not the number on the letter. You can also report it to the Better Business Bureau and your state’s insurance commissioner.

4. Can a real settlement check arrive without me filing a claim?

Yes, in some class action settlements, eligible consumers automatically receive checks even if they never filed a claim. This happens when the settlement administrator has enough identifying information to distribute funds directly. However, you should still verify the settlement is real before cashing the check by looking up the case online.

5. What should I do if I already cashed a fake settlement check?

Contact your bank immediately and explain that you may have deposited a fraudulent check. Report the incident to the FTC at ReportFraud.ftc.gov and file a complaint with your state attorney general’s office. If you wired money as part of the scam, contact your bank and the wire transfer service right away, as there is sometimes a short window to reverse the transaction. Consulting with an attorney can also help you understand your options.

Conclusion

Settlement scams are becoming increasingly sophisticated, and they target everyday people who are simply trying to recover what they are owed. Whether you received an unexpected check from an unfamiliar company, a letter referencing a lawsuit you don’t recognize, or a phone call pressuring you to act fast, the best thing you can do is pause and verify. Real settlements do not disappear if you take a day to confirm they are legitimate. Real administrators do not ask you to wire money. And real attorneys do not pressure you to sign documents without giving you time to review them. If something feels wrong, trust that instinct and contact a qualified attorney before taking any action.